The days of ‘beans in the teens’ may be ending, while corn might slide all the way to $4 a bushel

With last year’s drought largely behind them, American soybean and corn producers are eyeing bumper crops — and a sharp drop in price.

Prices have already dropped significantly and the market will likely deliver more bad news in the coming weeks, said Sterling Smith, a futures analyst with Citigroup in Chicago.

“We can attribute that mostly to very good growing conditions throughout the vast part of the U.S.,” said Smith. “We actually saw crop conditions improve one per cent in the good-to-excellent category. The crop is setting itself up to be potentially a very large harvest.”

Read Also

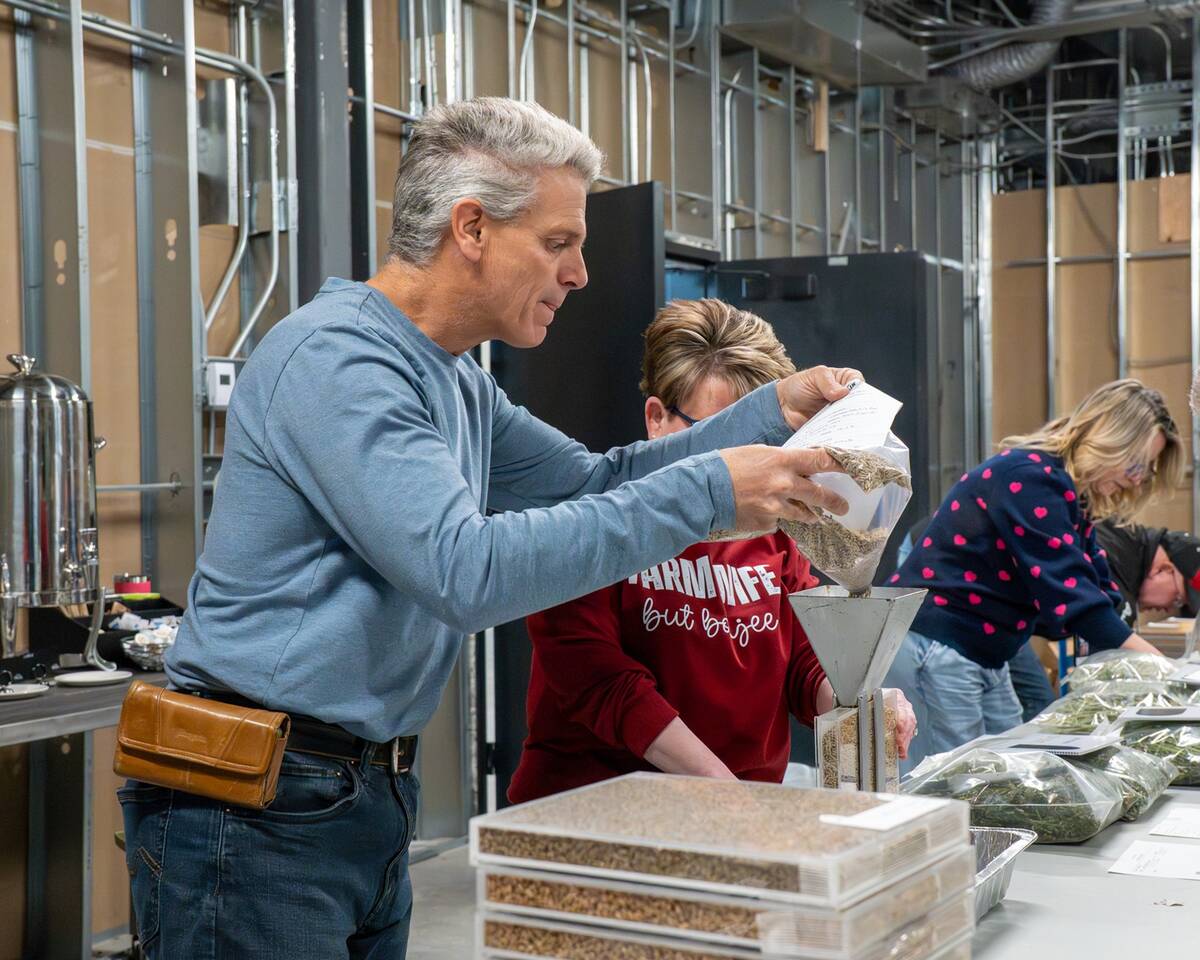

North American Seed Fair continuing a proud 129-year-old agricultural tradition

One of North America’s longest continually lasting seed fairs makes its 129th appearance in southern Alberta.

It would take bad news to reverse the current market trend, he said.

“The only thing I can see that would firm the market right now would be some sort of premature frost in growing areas, but that’s not happening realistically any time soon,” he said. “Right now, the best thing we could hope for is some short-covering rallies to come in and maybe stabilize prices a little bit.”

Assuming the soybean crop gets to harvest without any significant issues, Smith said prices could drop into the US$9.50-per-bushel range.

Weather has been the hot topic in the corn market now that crops are entering the pollination phase of development. Unlike last season, where extremely hot weather put major stress on the crop, corn is receiving cool, wet weather that is benefiting growth, Smith said.

“Weather for corn has been very good and we’ve had good growing conditions in a lot of places,” he said. “The two areas that we were concerned about for corn production were Nebraska and Iowa, but they did pick up some timely rain.”

With the USDA forecasting record corn production just below the 14-billion-bushel mark, Smith said he doesn’t see the market strengthening any time soon.

“We are going to be harvesting a bumper crop,” he said. “I think we’re going to be closer to 14 billion bushels than going over the mark. However, if we do see good rains in areas that have been stressed and there are no issues at harvest, there is the potential that we get over that.”

Prices could drop significantly lower than what we are already seeing, he said.

“I think we could see some sort of spike low between US$4 and US$4.25 (per bushel) range,” he said. “I think that when we get down to that point, the market is going to probably be as short as it can get, and with the ethanol demand, there should be people willing to scoop things up.”