With the most expensive crop ever planted mostly in the bin and the world becoming more unstable by the day, farmers face complex choices for canola marketing.

Should they sell what hasn’t been contracted to take advantage of prices hovering around $19 per bushel in early October? Or should they hold and wait for another market uptick?

It depends on individual farm needs and willingness to take risks, says one analyst.

Read Also

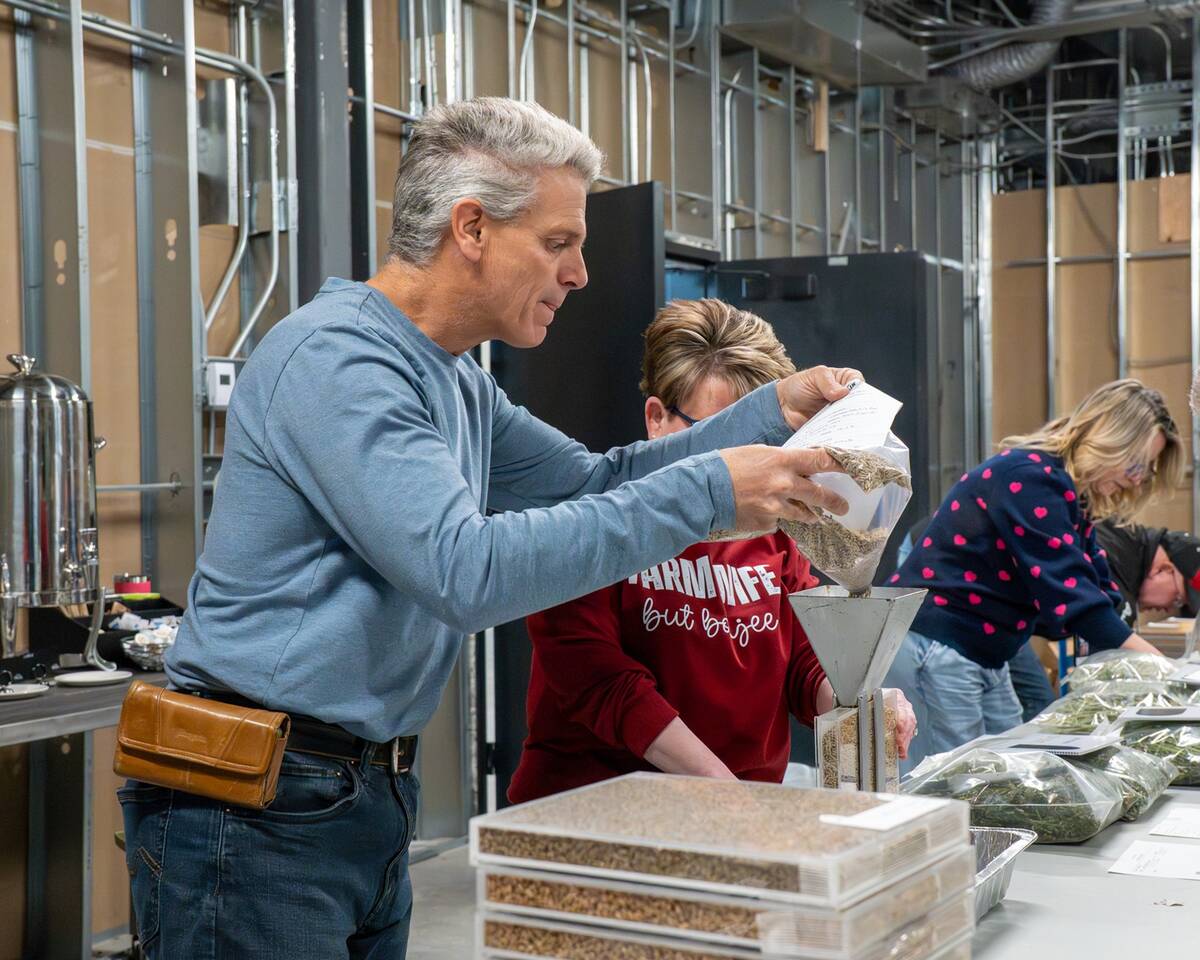

North American Seed Fair continuing a proud 129-year-old agricultural tradition

One of North America’s longest continually lasting seed fairs makes its 129th appearance in southern Alberta.

“Let’s say a farm is reasonably well sold on canola. Maybe they’ve got half their crop sold and they don’t necessarily need to move more canola any time in the next few months because they are in a better cash position,” said Jon Driedger of LeftField Commodity Research.

“Maybe canola isn’t a huge part of their crop mix. The answer to the question is maybe going to look a lot different than if a farmer basically grows mostly spring wheat and canola and they’ve got almost no canola sold and they have quite aggressively sold wheat.”

Farms lightly sold on canola should consider taking advantage of the current price rally “to lighten the load a bit,” said Driedger.

[RELATED] Prairie-wide canola variety trial program ending

Prices have potential to go higher but Canadian canola is expensive relative to global oilseeds, he added.

“The other part too, for farms that maybe say, ‘oh, maybe the canola crop isn’t quite there from what people were thinking, therefore the price must go higher’ (or) ‘Australia is probably looking at a big crop, so maybe we can’t export as much as we first thought,’” he said.

“That’s where I think some caution is warranted for farms about what the upside is going forward.”

In terms of obtaining paper positions for canola, Driedger said he’s a proponent of using futures and options to manage market uncertainty. However, most farmers don’t have trading accounts.

“If that is a tool you have in your toolbox, it does increase some flexibility of what you can do,” he said. “Now is one of those times when it could be useful as well. Try to find the balance between managing risk and uncertainty, knowing there are reasons prices could go higher.”

Canada’s canola harvest numbers will be smaller than anticipated, Reuters reported in mid-September, but farmers experienced the third-largest wheat harvest on record.

According to Statistics Canada, producers could harvest 19.1 million tonnes of canola, up 39 per cent from 2021, but down from its August estimate of 19.5 million.

[RELATED] Weekly Canadian canola exports climb higher

“It’s been dry in Western Canada the last month, so the crop probably didn’t fill as well as farmers had hoped,” Lawrence Klusa, president of Seges Markets, told Reuters last month.

There’s a lot of uncertainty in grain markets and there’s no crystal ball to figure things out, said David Bishop, who farms north of Lethbridge. He uses canola for cashflow to be sold when needed or when prices are favourable.

“Personally, and this is just my opinion, I could be totally wrong, I think there’s more potential for an upside on canola right now,” he said. “We have been moving some because it is a decent price.”

The war in Ukraine is also affecting grain prices and may continue to do so as the conflict escalates, said Bishop, noting Black Sea ports are severely restricted. In the end, though, he’s committed to good business decisions.

“When we market our grain, I used to think, ‘what if this happens and what if that happens?’ I can’t control that. If I look at the price and decide to sell some of it, I’m done. I don’t worry about it.”

Geopolitical problems are creating additional market risk for farmers, said grain analyst Brennan Turner.

“I’m probably about 30 to 25 per cent sold on a new crop before I even start harvest,” said Turner, speaking hypothetically. “My first priority is to fulfil those contracts. I don’t really like to contract in the middle of harvest because that’s usually when prices are at the lowest for the year.”

November to December is when Turner typically sees slightly higher canola prices but what happens this year is anyone’s guess. Grain companies start determining spring and summer delivery schedules in late January.

“The one thing to keep in mind is that crush margins in Canada right now for Canadian canola are very good for these crushers,” he said. “They are making quite a bit of money relatively speaking.

“Their goal is probably going to be continuing to maximize profit, and that requires continuing to put canola through the facility.”