Beyond Meat, Inc. has had almost 15 years to build a product lineup that is, as its name claims, beyond meat.

By some business metrics, it has. The company, whose market capitalization was pegged at US$1.3 billion when it went public in 2018, recently reported April-to-June 2023 sales of $102 million.

That sounds like a lot of non-meat meat. To the always ravenous Wall Street, however, the number is undercooked. Compared to a year ago, net revenue is off 31 per cent and U.S. sales are down 40 per cent.

Read Also

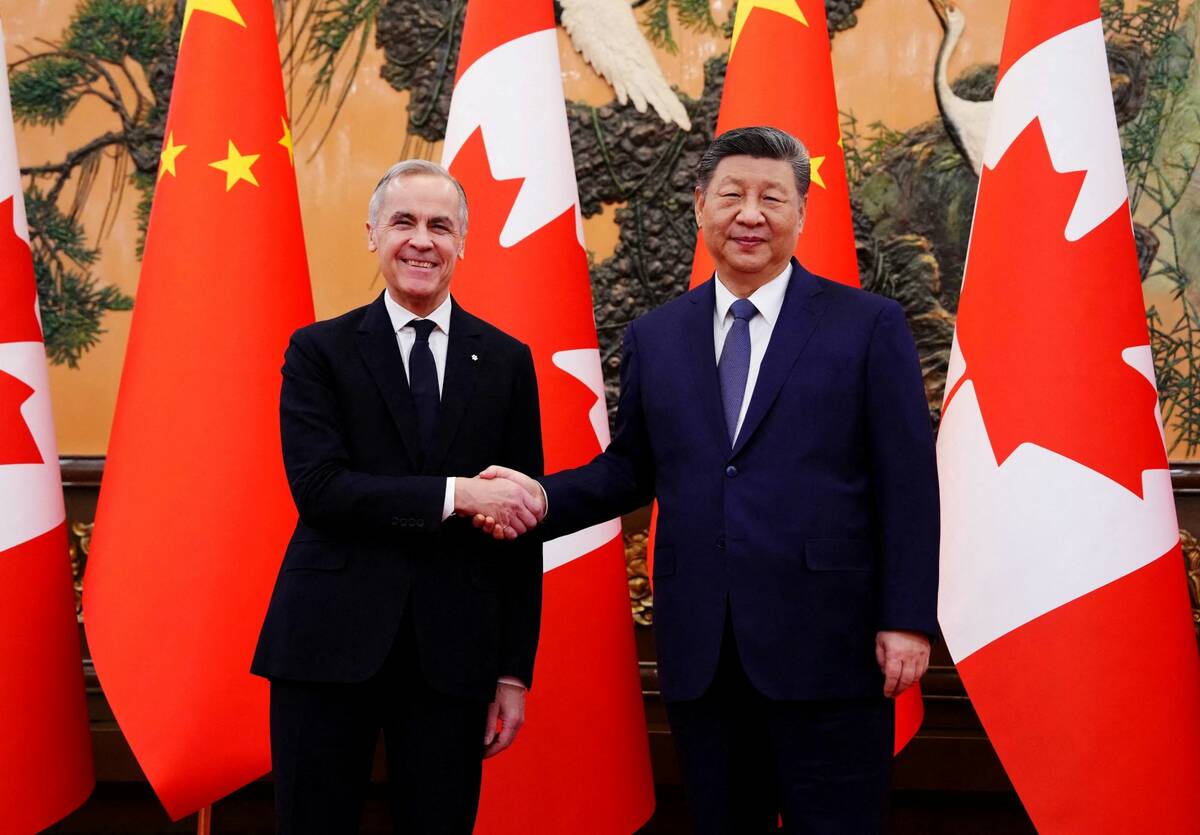

Pragmatism prevails for farmers in Canada-China trade talks

Canada’s trade concessions from China a good news story for Canadian farmers, even if the U.S. Trump administration may not like it.

Even worse, according to a comprehensive look at alternative meat companies published Aug. 9 in Plant Based News, “Beyond also backpedaled on its previous goal of achieving positive cash flow … saying this is now ‘unlikely’ to happen in 2023.”

That bad news sliced another 20 per cent off Beyond Meat’s stock price the next day, and again raised the broader question of whether plant-based meat is just another food fad.

Beyond’s biggest competitor, Impossible Foods, Inc., doesn’t seem to have a clear answer either. Like many of his veggie meat executives, Impossible’s boss, Pat Brown, predicted in 2020 that “his company would ‘take a double-digit portion of the beef market’ by 2024 before sending it into a ‘death spiral,’” noted last January.

Brown lobbed an even bigger brick at the sausage and bacon crowd: “Next, he would target ‘the pork industry and the chicken industry and say, “You’re next!” and they’ll go bankrupt even faster.’”

Beef didn’t enter a death spiral. In fact, it was Brown that was next; he stepped down as the company’s chief visionary officer over a year ago.

Since then, Impossible has gained a toehold in the veggie chicken nuggets niche. Still, in early 2023, investors saw their shares in the private company trading at around $12, or “about half the price during its last fundraising round,” Bloomberg again reported.

Fake meat isn’t the only novel food struggling to land in grocery carts. According to a Sept. 22 report, “Just Eat, Inc., a closely held maker of cultivated chicken and plant-based eggs, has dismissed roughly 40 employees, less than a month after raising $16 million…”

Perhaps the most remarkable part of that brief report is the apparent disconnect it highlights. Despite continued evidence that most consumers have a very limited appetite for non-meat meat and non-egg eggs, investors continue to throw venture capital at both half-cooked ideas.

Fake meat’s fizzle, believe some of its execs, is due largely to real meat’s campaign that attacked the fakers’ manufacturing and product content.

That could be part of it, but the more likely explanation is simpler: The vast majority of North American eaters so far just don’t want fake meat, regardless of purported benefits like a healthier diet and a healthier planet.

New idea or old, if food dollars don’t vote for it, there’s little that any company — be it wealthy and global like Coca-Cola or new and niche like Impossible Foods — can do to turn it into the dinner centrepiece of choice.

Real red meat, real poultry, real eggs or even real mayonnaise, another target of food transformers, are not going away, let alone bankrupt, anytime in the foreseeable future. But neither is the veggie gang. Their time may yet come.

Until then, want to share their bacon?