As we enter another growing season, farmers are raising concerns over the federal government’s intention to review the option to defer cash purchase tickets — something that came with no warning prior to its mention in the federal budget.

From where I sit, a mid-size incorporated family grain farm, we know that the reversal of this option will have a drastic impact on our profitability and bottom line.

In the recently released report by the federal government’s Advisory Council on Economic Growth (Unleashing the Growth Potential of Key Sectors), agriculture and agri-food was named as a key sector to increase economic growth for Canada. The report cites “the large natural endowment of water and arable land” and “exposure to favourable global market trends including demand from fast-growing Asian economies” among a number of other factors.

Read Also

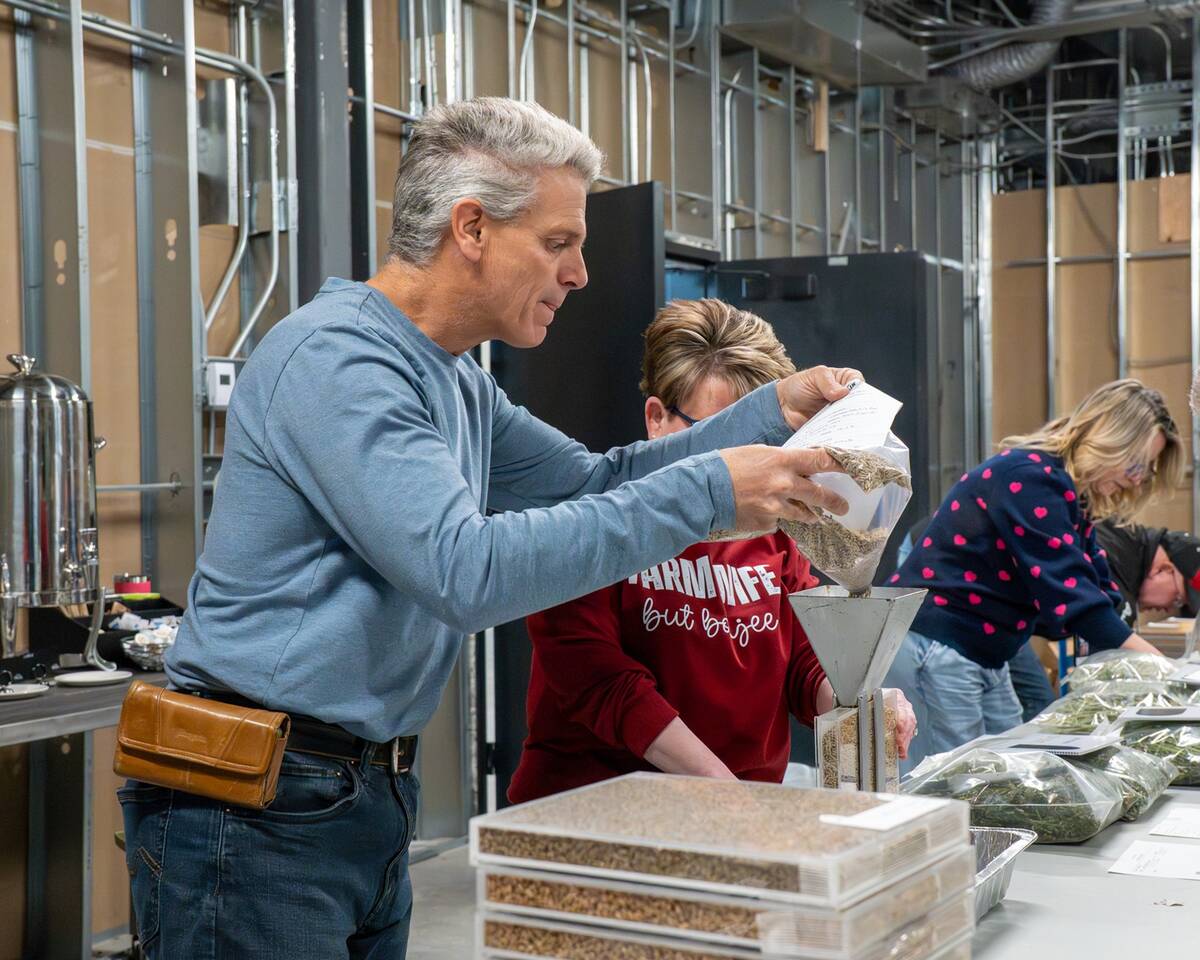

North American Seed Fair continuing a proud 129-year-old agricultural tradition

One of North America’s longest continually lasting seed fairs makes its 129th appearance in southern Alberta.

According to the same report, the agriculture sector employs 2.1 million Canadians and accounts for 6.7 per cent of GDP “with lots of potential for growth” — numbers we don’t dispute. We know the resiliency of our agriculture industry makes it a key sector for economic prosperity.

- Read more: Tax treatment of deferred grain cash tickets under review

- Read more: Alberta Wheat fighting to keep tax deferral

But do you know what will impede this cited opportunity for economic growth?

Placing grain producers, who are key to the economic growth in this sector and this country, at a distinct disadvantage.

Grain producers are unique in that we must buy our inputs retail and sell our grain products wholesale. We are price takers. We do not have the opportunity to pass on increased costs that we shoulder. We are also unique in that our income is not stable — our yields and subsequent profits vary from year to year. But this shouldn’t be new information.

One of the key ways to manage cash flow and fluctuating yields is to be able to defer cash tickets out to the following year. As small family businesses (which is the majority of farm operations), we can ensure income stability in the next year and manage tax paid in the current year.

Let’s be clear on this — we are not avoiding tax, we are simply deferring it to the following tax year.

Though the response to this issue has largely been that of great concern for the loss of this key management tool, it’s also been suggested that the benefits of deferring income are inflated. For incorporated farms, it’s conceptually true that dividends can be taken to ensure a lower tax rate on income incurred over the small business threshold of $500,000. But this is not a realistic fiscal management practice for several reasons. There are limits to personal dividends that can be taken from a farm corporation, and most importantly, the opportunity for growth would be lost in a year of higher revenue (i.e. increasing farm capital and assets). Instead of taking a dividend, income over $500,000 can be deferred and used by the farm corporation the following year.

The pressure on our margins is ever increasing (for example, Alberta’s carbon tax) and should this option be removed, we’ll feel it even more.

As it currently stands, we choose to sell our grain into the top of the market, no matter what tax year this sale may occur. Should this option be removed, we’ll likely find ourselves forced to sell our product at less than desirable prices to manage tax that is paid. Not to mention the potential ripple effects of grain moving (or not moving) through the value chain, essentially stifling any economic growth targets.

The Advisory Council report cites that it wants Canada to grow to be the second-largest agricultural exporter on the world stage — targeting an eight per cent share of global ag exports and more specifically, targeting pulses and oilseeds as key export areas for growth.

I believe the sector will respond with a resounding yes in support of trying to reach these goals. But we can’t do that if producers are at odds with our government.

The reaction and response of producers and industry to this review speaks for itself. Agriculture needs a seat at this consultation table, hopefully across from policy-makers who are willing to listen.