Ottawa — Minor changes are coming to AgriStability following Tuesday’s meeting between federal Agriculture Minister Marie-Claude Bibeau and her provincial counterparts. Major changes, however, will have to wait. A full review of federal business risk management (BRM) will be completed in April, with the findings discussed when the federal, provincial and territorial ministers meet again […] Read more

Feds, provinces plan minor tweaks to AgriStability

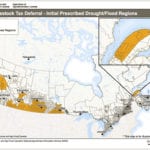

Livestock tax deferral map expands again for 2018

Some northern and southwestern Ontario producers who had to sell breeding livestock due to drought in the 2018 tax year can now defer chunks of the income from those sales when filing their income taxes. The federal government on Wednesday rolled out its final list and map of designated regions for 2018 under its livestock […] Read more

Tax relief offered to livestock producers short on feed

If you’re forced to sell breeding stock but planning to restock, you can defer taxes for a year

Reading Time: < 1 minute Twenty-one counties and municipal districts in Alberta are on the “initial list” of regions where livestock producers can defer taxes because of feed shortfalls. The federal government’s Livestock Tax Deferral Provision program allows producers to defer a portion of their 2018 sale proceeds of breeding livestock until 2019 to help replenish the herd. The cost […] Read more

All quarantines lifted in bovine TB probe

The mystery of how six Prairie cattle caught a Mexican strain of bovine tuberculosis (TB) is now expected to remain a mystery indefinitely. The Canadian Food Inspection Agency on Monday announced quarantines have been lifted from all Prairie cattle operations tested during its probe of a bovine TB outbreak beginning in the fall of 2016. […] Read more

Saskatchewan, B.C. areas up for livestock tax deferrals

Livestock producers in several more parched municipalities in Saskatchewan and British Columbia will be able to defer income from sales of animals on their 2017 tax returns. The federal government on Tuesday announced its final list of designated regions for 2017, including 20 more municipalities in Saskatchewan and seven in British Columbia. The initial list, […] Read more

CN’s Q4 grain handle down in ‘challenging conditions’

U.S. income tax reform more than offset “challenging” conditions, including reduced grain handle, in Canadian National Railway’s fourth fiscal quarter. Montreal-based CN on Tuesday reported net income of $2.611 billion on total revenues of $3.285 billion for its fourth quarter ending Dec. 31, up from $1.018 billion on $3.217 billion in the year-earlier Q4. The […] Read more

What’s the view from your farm in 2027?

Long-term planning is easy to put off, but there can be a steep price to pay, says financial specialist

Reading Time: 2 minutes No matter what age, it’s never too early or late to put together a long-term plan for your farm, says a provincial financial specialist. “Farmers are always busy with their daily and seasonal tasks,” says Rick Dehod. “When asked what their plan is for the next 10 years, they often say they haven’t had a […] Read more

Ottawa scraps plans for new limits on capital gains

The federal finance ministry has backed away from proposed plans for new limits on capital gains exemptions, over concerns of “unintended consequences” for businesses such as farms. Finance Minister Bill Morneau on Thursday announced the federal government “will not be moving forward with measures that would limit access to the LCGE (lifetime capital gains exemption),” […] Read more

Worried about federal tax changes? There’s an alternative, say experts

Federal Liberal bid to close ‘loopholes’ will increase taxes on most farm corporations, but there’s a way to avoid that hit

Reading Time: 3 minutes Proposed federal tax changes aimed at ‘income sprinkling’ and other tax reduction measures used by corporations — including those owned by farmers — have ignited a storm of controversy. But there are “a lot of other tax strategies” that farmers can use, say financial planning experts. In July, federal finance officials announced proposed changes to […] Read more

Drought-related livestock tax deferral zones widen again

More ranchers in five provinces may now be able to defer some of their taxable income from their livestock sales in 2016 due to drought. The federal government on Aug. 4 announced its final list of drought-designated regions where the livestock tax deferral provision will be allowed for the 2016 tax year, and has included […] Read more