Reading Time: < 1 minute Wheat producers who pay checkoff through the Alberta Wheat Commission and do not request a refund are eligible for a 74 per cent tax credit through the Scientific Research and Experimental Development Fund (SR&ED) program for their investment in wheat research and development projects. For example, producers who paid $100 in checkoffs to AWC in […] Read more

Wheat producers can claim tax credit on checkoffs

Those who paid $100 in checkoffs to AWC in 2022 would earn $74 in tax credit

Get a tax credit on checkoffs

Reading Time: < 1 minute Crop commissions are reminding growers that they can get a tax credit for their checkoffs. The Scientific Research and Experimental Development Fund (SR&ED) program is based on the percentage of a checkoff that is used for crop research and development — an amount that varies for each crop. For barley, every $100 in 2021 checkoffs […] Read more

Tax records show decline in Alberta farmers’ income

The StatCan data isn’t easy to parse, but the trend in recent years has been downwards

Reading Time: 2 minutes Even before the pandemic and the drought, Alberta farmers — along with their Canadian counterparts — saw their incomes drop, according to the latest report from StatCan. “Farm families in Alberta earned the highest average total income nationally for a second consecutive year in 2019,” the federal agency said in a recent report. “However, their average […] Read more

Top 12 tax-saving tips for your farm

Some require help from an accountant or adviser, but others are things you can do yourself

Reading Time: 4 minutes Every farmer wants to pay less in taxes, but it can be hard to know where to find those savings. “How do you feel confident you’re paying the least amount of tax possible? It’s tough,” said Carman Praski, business development representative at Farm Business Consultants. At the recent Ag in Motion virtual conference, Praski offered […] Read more

Argentine soybeans facing tax increases

MarketsFarm — Not many major divergences can be seen between the U.S. Department of Agriculture’s data (USDA) on Argentina’s soybean crop and data from the department’s attaché in Buenos Aires. What may bring changes to the country’s soybean industry are tax increases imposed by the new federal government, according to Benjamin Boroughs, the USDA attaché. […] Read more

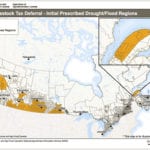

Livestock producers receive tax relief for 2019

Drought in Western Canada and Quebec has prompted the federal government to release an initial list of regions eligible for livestock tax deferrals. The livestock tax deferral provision allows livestock producers in prescribed drought, flood or excess moisture regions to defer a portion of their 2019 sale proceeds of breeding livestock until 2020 to help […] Read more

Ten more counties eligible for tax relief

Livestock tax deferral program assists livestock producers who had to cull their herd this year

Reading Time: < 1 minute Another 10 Alberta municipalities are now eligible for the federal government’s livestock tax deferral program. Agriculture and Agri-Food Canada’s initial list of eligible municipalities issued in September has been expanded to include many counties passed over the first time. Municipalities are only eligible for the program if forage yields fall below 50 per cent of […] Read more

Tax relief offered to livestock producers short on feed

If you’re forced to sell breeding stock but planning to restock, you can defer taxes for a year

Reading Time: < 1 minute Twenty-one counties and municipal districts in Alberta are on the “initial list” of regions where livestock producers can defer taxes because of feed shortfalls. The federal government’s Livestock Tax Deferral Provision program allows producers to defer a portion of their 2018 sale proceeds of breeding livestock until 2019 to help replenish the herd. The cost […] Read more

Horses should be classed as livestock, argues industry group

Horse industry should receive the same benefits as other livestock sectors, says Horse Welfare Alliance of Canada

Reading Time: 2 minutes Horses and other equines should be formally classed as livestock, says an advocacy group. “We have situations in various parts of Canada where provincial governments, in British Columbia in particular, are denying farmer status to people who are in the business of breeding equines including mules, donkeys, and horses,” said Bill desBarres, chair of the […] Read more

Dodging the taxman may be costing you

Paying some tax makes sense, but cash deferrals and pre-buying inputs don’t always, says accountant

Reading Time: 3 minutes Some of the farmers Rob Strilchuk works with seem to think that $1 is too much tax to pay. “I have clients who spend $100 to save $15 in tax,” said the MNP accountant. “I get it. I don’t want cash to go to Revenue Canada for any of my clients, either. But there is […] Read more